Fraud filters or fraud rules are fraud prevention rules available in Converge to protect your online transactions from authorization testing.

*Only users with edit business rule" rights are able to modify rules

** Make sure you are setting the rules on the right terminal

To Set Fraud Filters / Fraud Rules:

Step 1 - Go to Settings

Step 2 - Select Fraud Prevention Tools

Step 3 - Set the appropriate rules

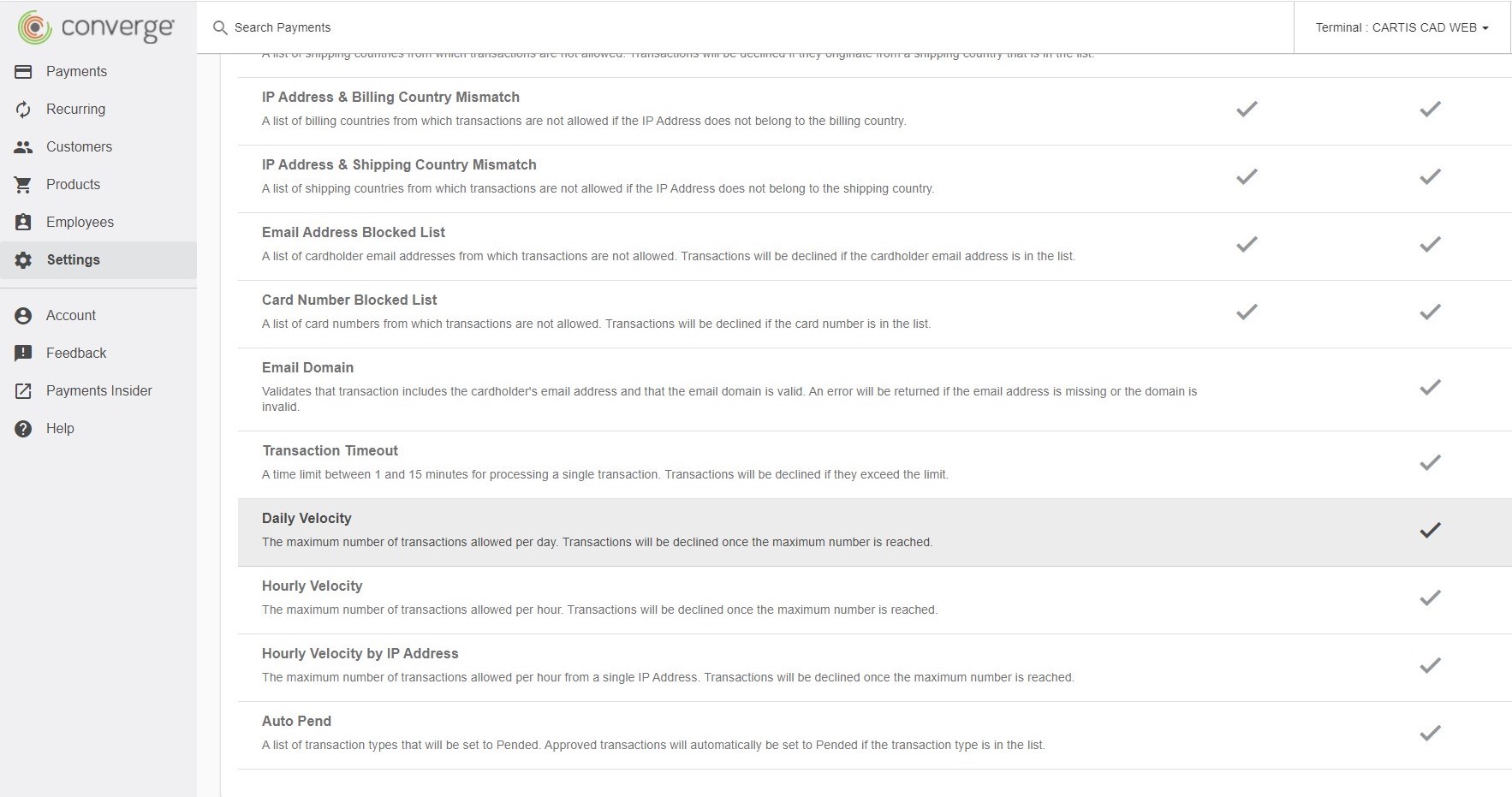

Commonly Available Fraud Rules (see attached):

Shipping / billing / IP country blacklist - you can set transactions to decline when the shipping or billing country or IP address field contains a blacklisted country that you set.

***to set any of the IP filters the integration API must pass the IP address in the request, otherwise all transactions will be blocked by the filter.

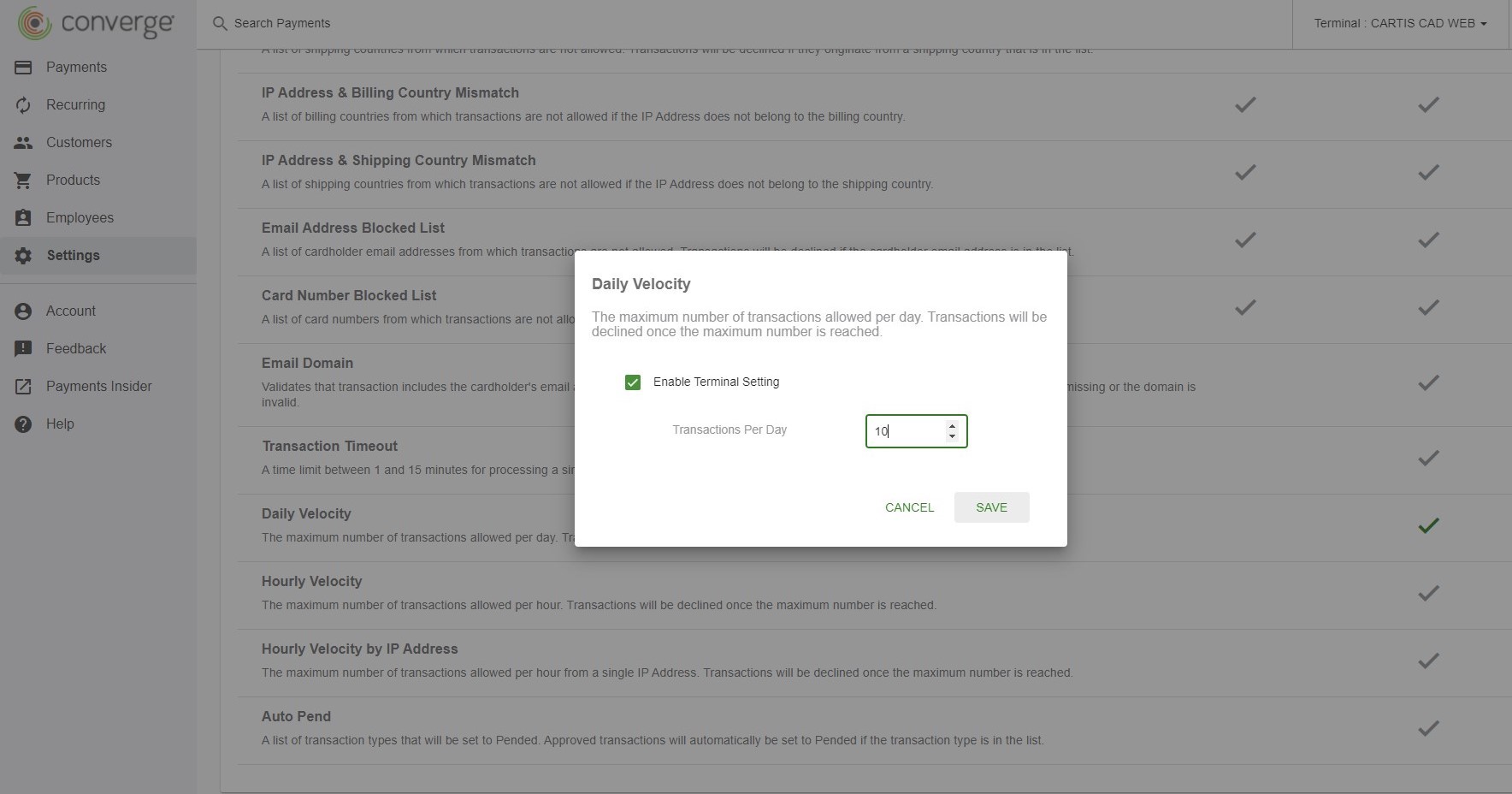

Velocity Filters - these are available to be set for per day, per hour, or per hour by IP address (or all three). This would set the maximum allowable number of transactions you will accept through your terminal / website.

To set velocity filters:

Select the option to set (i.e. daily)

Check off Enable Terminal Setting

Enter the amount of transactions (note: anything above this amount will not go through)

Press Save

Auto Pend - allows you to set certain transactions (i.e. refunds) to be pended to allow for you to review for legitimately before letting them go through.

Setting Custom Rules:

Converge has the option to set custom rules (see tab next to fraud rules in the fraud prevention rule screen) which can set certain transactions to be reviewed or declined or an email to be sent whenever a set situation occurs.

Common Custom Rules:

Setting a maximum transaction amount - where transactions above your threshold would be automatically declined or set to be reviewed (pended)

CVV / AVS Match - CVV and AVS are good tools to ensure a transaction is not being completed with a stolen card. You can set transactions that have an incorrect CVV or AVS to decline automatically.